It started, as these things often do, with an alert. A notification, a ping, a fleeting moment of digital unease. For a man in Kolkata, that ping signaled the start of a financial nightmare.

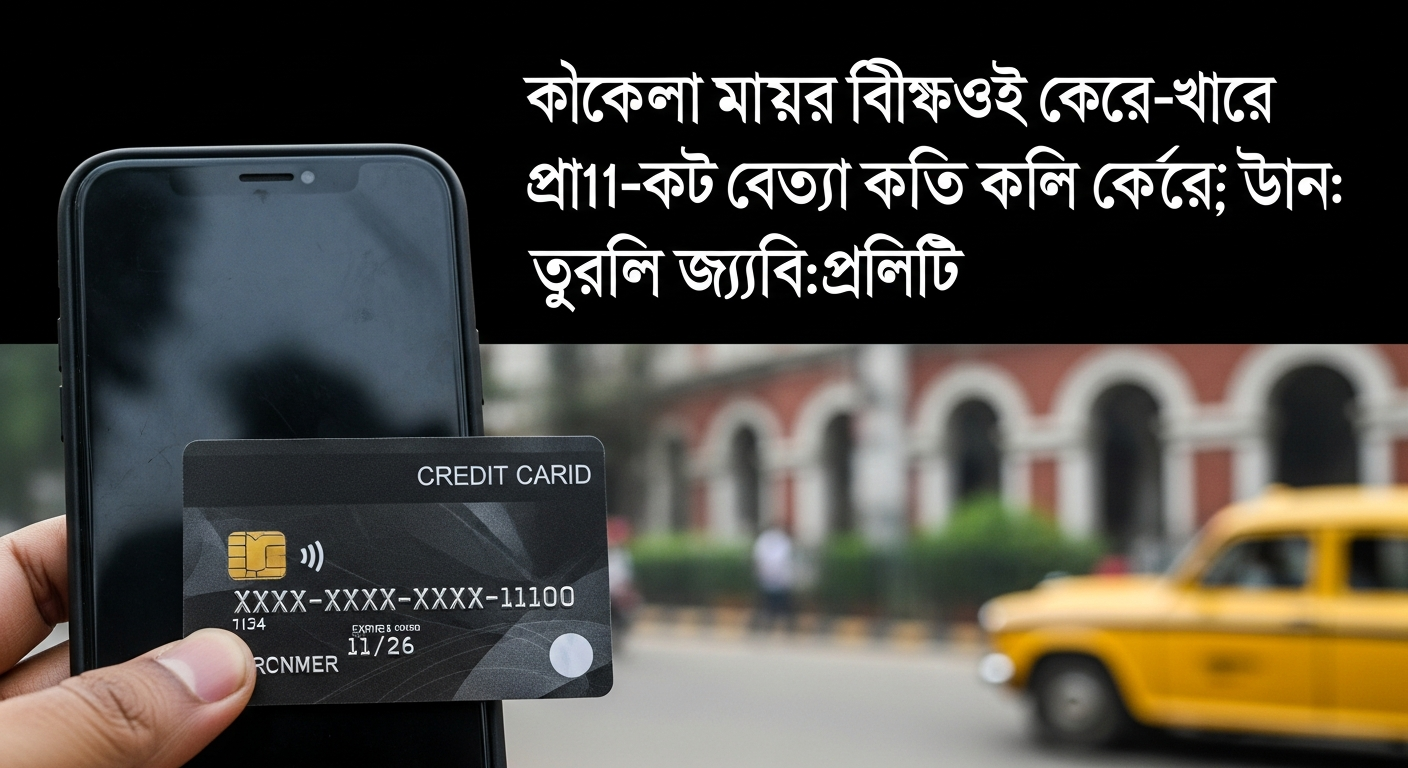

According to recent reports, he’d been targeted in a credit card cloning scheme. The result? A staggering loss of ₹11 lakh. That’s a lot of money – enough to shake anyone’s sense of security, I imagine.

Credit card cloning, at its core, is a sophisticated form of theft. It involves criminals creating a duplicate card using the data from a legitimate card. Think of it as a digital forgery, where your financial information becomes the currency.

The process, as explained in a recent Mint article, typically involves copying the data from the magnetic stripe of a legitimate card onto a blank one. It’s a method that has evolved over time, becoming more complex as security measures improve. But the aim always remains the same: to access and misuse someone else’s money.

The Kolkata incident, however, is a stark reminder of the very real threat of cybercrime. The details are still emerging, but the police are investigating, trying to trace the digital breadcrumbs that led to this loss. It seems like the investigation is ongoing.

Meanwhile, the victim, like so many others, is left to deal with the aftermath. The shock, the paperwork, the feeling of violation. It’s a violation of trust, really. You hand over your financial information, and you expect it to be safe. For once.

How do you protect yourself? Experts recommend several precautions. Regularly monitor your credit card statements for any unauthorized transactions. Set up alerts for any activity on your card. Be wary of suspicious emails or phishing attempts. And, of course, be cautious when using your card online or at unfamiliar locations.

“It’s a constant battle,” a cybersecurity analyst mentioned in the Mint report. It’s a good point. The criminals are always looking for new ways to exploit vulnerabilities. So, we all need to stay vigilant.

The scale of the problem is hard to grasp. This one case, in Kolkata, is just a single data point. The total amount lost to credit card fraud across India in a single year probably runs into the crores. It’s a hidden tax, a cost of living in the digital age.

The story in Kolkata is still unfolding. But one thing is clear. The threat is real. And it’s something we all need to take seriously.

No Comments

No Comments