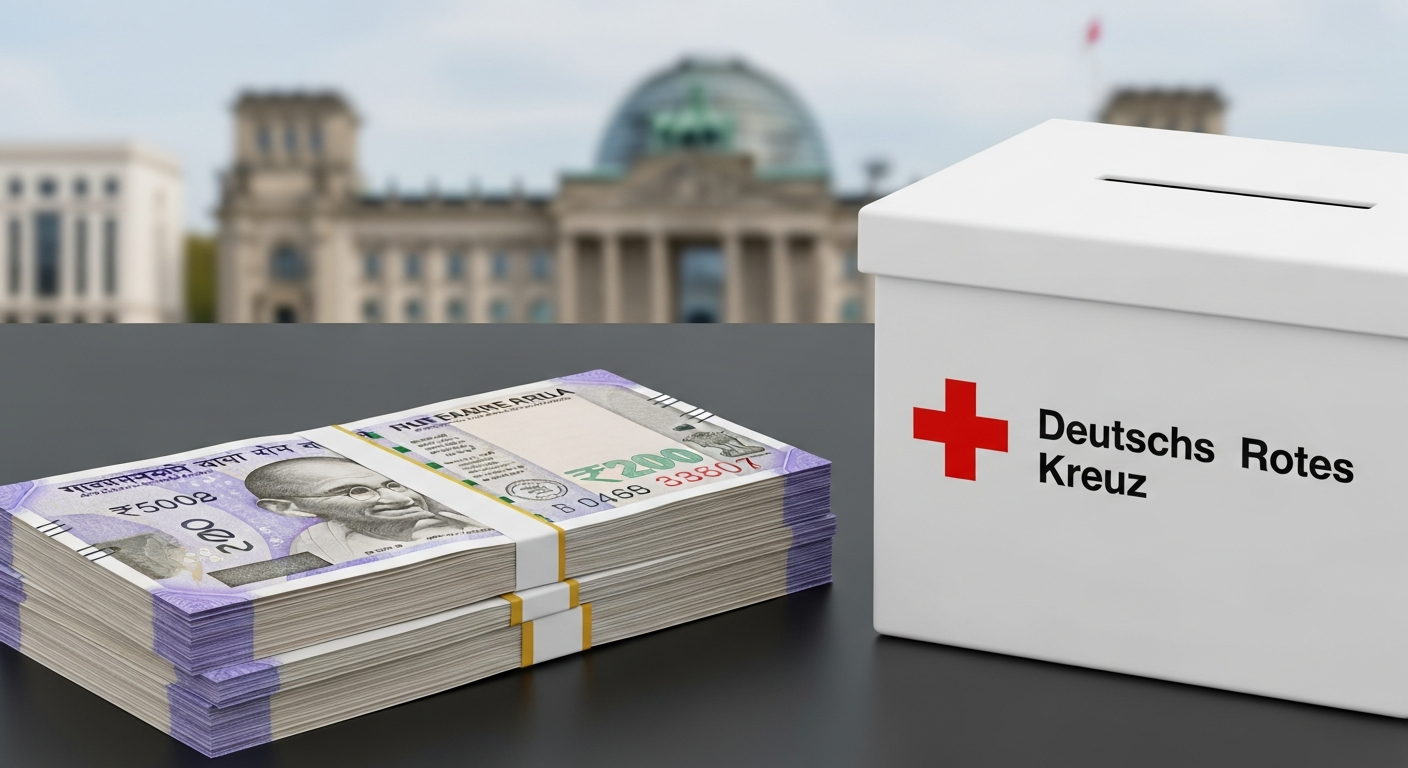

So, you’re feeling generous and want to donate to the German Red Cross. That’s fantastic. But if you’re an Indian resident, there’s a bit more to think about than just the good you’re doing. Yep, we’re talking taxes. Specifically, how your donation might be viewed by the Indian taxman.

It’s a pretty common scenario, actually. You want to help, but you also don’t want a surprise bill later. The key thing to remember is that when you donate to a foreign charity, like the German Red Cross, you’re entering a slightly different tax landscape than if you were donating locally.

The first thing that pops up is the possibility of Tax Deducted at Source (TDS). Now, TDS is a familiar concept in India. It basically means that tax is deducted at the source of the income or payment. In the context of donations, it’s something to keep an eye on. You’ll want to understand if TDS applies to your donation and, if so, at what rate. It depends on the specifics, so it’s not a one-size-fits-all answer.

Then there’s the Double Taxation Avoidance Agreement (DTAA). India has DTAAs with many countries, including Germany. The goal of a DTAA is to prevent you from being taxed twice on the same income – once in India and again in Germany (though in this case, it’s about the donation, not income). If you’re eligible for DTAA relief, it could significantly impact your tax liability. It’s definitely something to investigate.

Now, let’s talk about the Liberalised Remittance Scheme (LRS). This is a scheme by the Reserve Bank of India (RBI) that allows resident individuals to remit funds abroad for various purposes, including donations. The LRS has its own set of rules and limits. Under the LRS, there are certain tax implications and reporting requirements. This is where things can get a little complex, so you’ll want to be well-versed with the LRS guidelines.

Here’s a quick heads-up: The government could also apply the Tax Collected at Source (TCS) rules under the LRS. TCS means that the seller collects tax from the buyer at the time of the transaction. This is relevant when you are sending money abroad. The TCS rate and rules depend on the amount and nature of the remittance. So, knowing about TCS is important to avoid any unexpected tax burdens.

Anyway, navigating all of this can feel a bit like wading through alphabet soup – TDS, DTAA, TCS, LRS… But don’t worry, you don’t have to do it alone. The best approach is to gather all the necessary information, understand your specific situation, and, if needed, consult a tax advisor or a financial expert.

Why is all this important? Well, because understanding these tax implications helps you make informed decisions. It ensures that your generosity doesn’t inadvertently lead to unwanted tax liabilities. It also helps you stay compliant with Indian tax laws.

So, before you send that donation to the German Red Cross, take a few minutes to understand the potential tax implications. It’s all about being prepared and making sure your good deed doesn’t come with an unexpected cost. It’s about being a responsible donor, and honestly, it’s worth the effort.

No Comments

No Comments