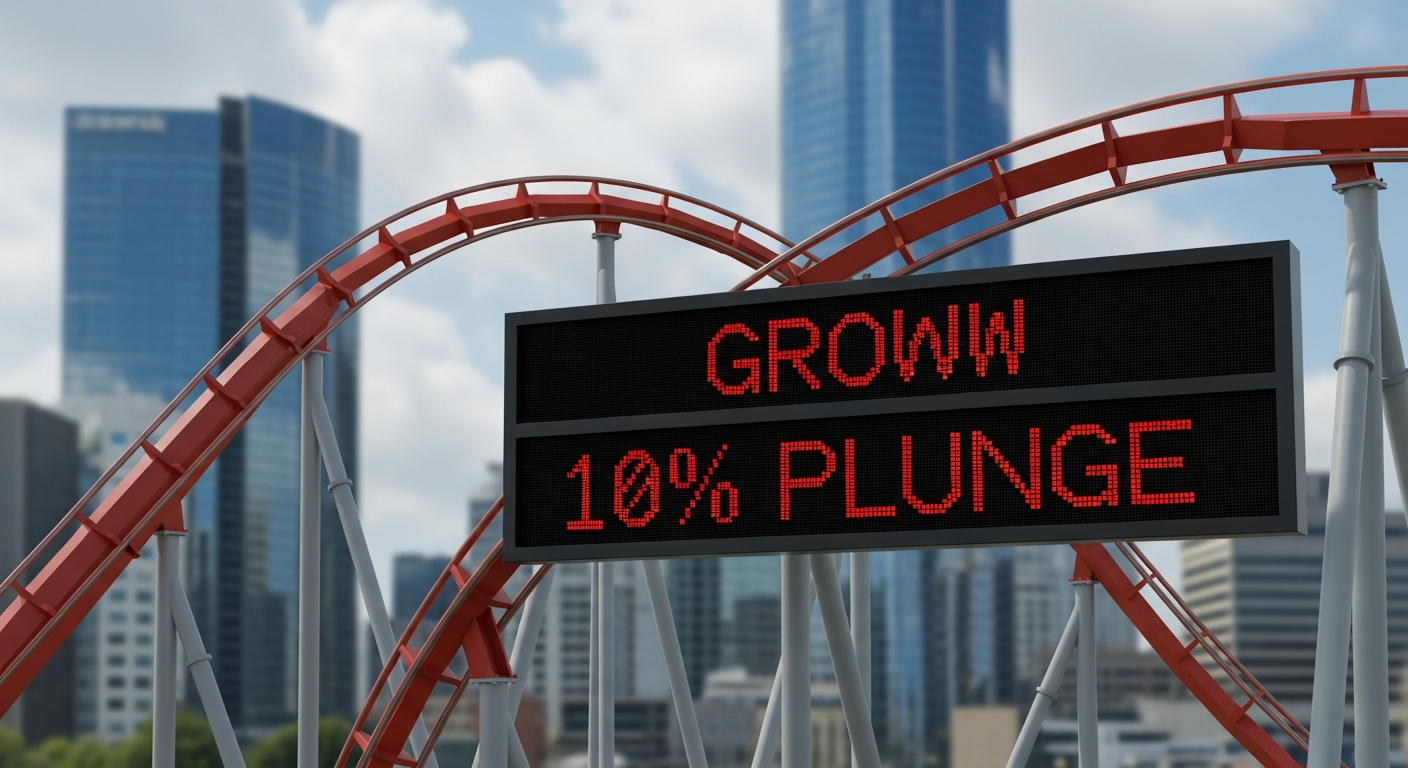

The trading floor hummed. Not with excitement, but a low thrum of… something else. Shares of Billionbrains Garage Ventures Ltd., Groww’s parent company, had just hit the lower circuit. That’s market code for ‘halt,’ a 10% drop.

It was a stark contrast to the post-listing euphoria. The stock had rallied 70% since its debut. Now, at INR 169.94, the gains seemed to be… evaporating.

This isn’t just numbers on a screen; it’s a story playing out in real-time. Investors, traders, the analysts – all watching the dance of supply and demand. What were they thinking? What moves were they making? The air in the room felt thick with unspoken questions.

“It’s a correction, plain and simple,” offered a veteran trader, his eyes glued to his monitor. He preferred to remain anonymous, the way things were.

Groww, the investment platform, has become a household name in India, especially among younger investors. Its user-friendly interface and focus on commission-free trading fueled its rapid growth. But rapid growth can be a double-edged sword, as the market is reminding everyone.

The ‘why’ is complex. Market corrections are rarely simple. Profit-taking, broader market trends, and perhaps a touch of overvaluation all likely played a part. The ‘when’ was immediate: post-listing. The ‘what’ was a swift, decisive drop.

The scene: a trading floor, late afternoon. The screens displayed a sea of red. The mood: cautious, to say the least. The fact is, the market doesn’t care about narratives; it cares about price.

What happens next? That’s the question everyone’s asking. Will this be a temporary blip, or the start of something more significant? The market, as always, has the final word.

Inc42 Media reported the initial drop. This is the reality of the market. And it’s a stark reminder that what goes up… doesn’t always stay there.

No Comments

No Comments